Discover Every Little Thing Concerning Home Mortgages In This Short Article

Content by-Hodges GottliebWhen you realize the time has come to buy a home, many thoughts will cross your mind. One of the first is often the fact that you need to seek out a mortgage to fulfill your dream. The tips below will help you get the job done right so you can move quickly.

When you struggle with refinancing, don't give up. New programs (HARP) are in place to help homeowners out in this exact situation, no matter how imbalanced their mortgage and home value seems to be. Consider having Learn Even more Here with your mortgage lender to see if you qualify. If your lender is still not willing to work with you, find another one who will.

Before you refinance your mortgage, make sure you've got a good reason to do so. Lenders are scrutinizing applications more closely than ever, and if they don't like the reasons you're looking for more money, they may decline your request. Be sure you can accommodate the terms of the new mortgage, and be sure you look responsible with the motivations for the loan.

Consider a mortgage broker instead of a bank, especially if you have less than perfect credit. Unlike banks, mortgage brokers have a variety of sources in which to get your loan approved. Additionally, many times mortgage brokers can get you a better interest rate than you can receive from a traditional bank.

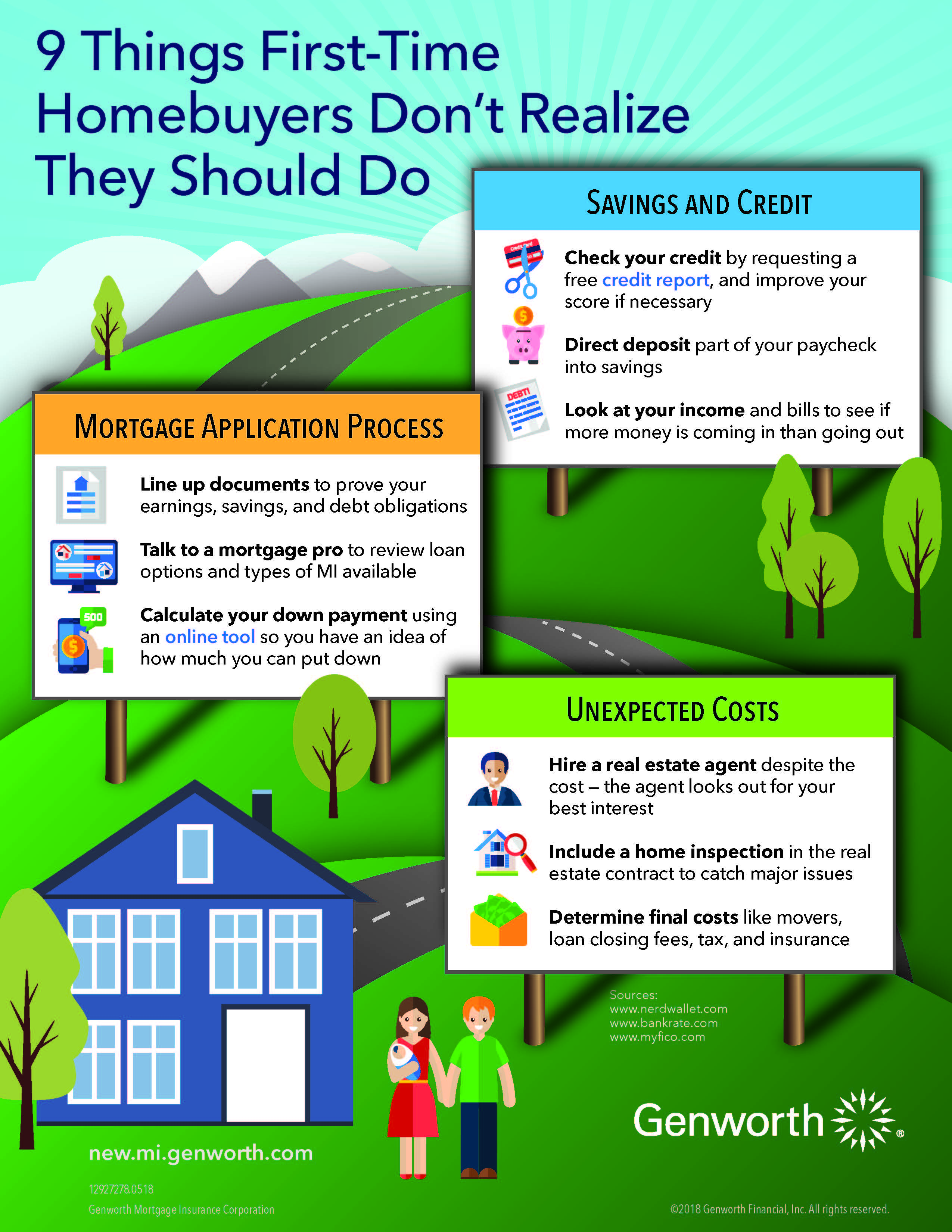

Make sure you know how much you can afford before applying for a mortgage. Do not rely on what your lender says you can afford. Make a budget, allowing room for any unexpected expenses. Use online calculators which can help you estimate how much mortgage you can afford to pay monthly.

When you see a loan with a low rate, be sure that you know how much the fees are. Usually, the lower the interest rate, the higher the points. These are fees that you have to pay out-of-pocket when you close your loan. So, be aware of that so you will not be caught be surprise.

A good credit score is essential if you want to finance a home. If your score is below 600 you have some work to do before you can hope to purchase a home. Begin by getting a copy of your credit record and verifying that all the information on it is correct.

Choose your mortgage lender many months in advance to your actual home buy. Buying a home is a stressful thing. There are a lot of moving pieces. If you already know who your mortgage lender will be, that's one less thing to worry about once you've found the home of your dreams.

Consider a mortgage broker for financing. They may not be as simple as your local bank, but they usually have a larger range of available loans. Mortgage brokers often work with numerous lenders. This allows them to personalize your loan to you more readily than a bank or other finance provider.

Make sure you're not looking at any penalties when you apply for a new mortgage. Your old mortgage may impose fines for early payment, which can include refinancing. If there are fines, weigh the pros and cons before getting into a new mortgage, as you may end up paying a lot more than you expected, even though refinancing means a lower monthly payment.

Refinancing a home mortgage when interest rates are low can save you thousands of dollars on your mortgage. You may even be able to shorten the term of your loan from 30 years to 15 years and still have a monthly payment that is affordable. You can then pay your home off sooner.

If you are having problems paying your home mortgage, contact your lender immediately. Don't ignore the problem. That'll only make the issue worse. Your lender can show you many different options that may be available to you. They can help you keep your home by making the costs more affordable.

Before you contact a mortgage lender to apply for a loan to buy a home, use one of the fast and easy mortgage calculators available online. You can enter your loan amount, the interest rate and the length of the loan. The calculator will figure the monthly payment that you can expect.

During your application for a home loan, get a rate-lock. A rate-lock in writing guarantees certain terms and interest rates for a given period of time. Set the rate-lock "on application" instead of "on approval". great site -in period needs to be long enough to allow for factors that can delay the loan process.

If you need to make repairs to your home you may want to consider a second home mortgage. As long as you have a good history of paying on time you should be able to get a great rate, and by improving your home you are increasing its value. Just be sure that you will be able to make the payments.

Be realistic when choosing a home. Just because your lender pre-approves you for a certain amount doesn't mean that's the amount you can afford. Look at your income and your budget realistically and choose a home with payments that are within your means. This will save you a lifetime of stress in the long run.

Contrary to popular belief, there are plenty of lenders out there who will loan to you. So you need to shop around with your loan options. Never jump at the first opportunity you find. This will leave you paying far too much and will leave you obligated to a loan whose terms are not favorable to you.

If you're not a good negotiator, hire a mortgage broker. The lender will pay their commission, which means you don't have to pay for their help, which saves you time and money. They'll be able to locate a great rate with great terms for you without any time spent on your part.

Never choose a home mortgage from a company that asks you to do unscrupulous things. If a rep is asking you to claim more than you make to secure the mortgage, it's not a good sign that your mortgage is in good hands. Walk away from these deals as quickly as you can.

While the process of getting a mortgage can be daunting, the results are well worth it. As you move into your home, you'll realize your dreams are finally achieved. Home ownership brings great responsibility and rewards, so enjoy it all yourself by using the tips above and getting a great mortgage.